Navigating Volatility: Tips for Successful Trading in Turbulent Markets

In the fast-paced world of trading, volatility is a constant companion. While it can present opportunities for profit, it also comes with its fair share of risks. Whether you’re a seasoned trader or just starting out, understanding how to navigate volatility is essential for success. In this blog, we’ll explore some valuable tips to help you trade with confidence, even in the most turbulent of markets.

Stay Informed and Adapt Quickly

In volatile markets, information is power. Stay updated on the latest news and developments that could impact the assets you’re trading. Whether it’s economic data releases, geopolitical events, or corporate earnings reports, being informed allows you to anticipate market movements and adjust your trading strategy accordingly. Remember, the ability to adapt quickly is key to staying ahead of the curve in volatile markets.

Set Clear Goals and Risk Management Strategies

Before making any trades, it’s essential to establish clear goals and risk management strategies. Define your objectives, whether it’s short-term gains or long-term growth, and set realistic targets for each trade. Additionally, implement risk management techniques such as setting stop-loss orders to limit potential losses and diversifying your portfolio to spread risk across different assets. By having a clear plan in place, you can trade with confidence and mitigate the impact of market volatility on your portfolio.

Exercise Patience and Discipline

In volatile markets, it’s easy to get caught up in the frenzy of rapid price fluctuations. However, it’s crucial to remain patient and disciplined in your approach to trading. Avoid making impulsive decisions based on emotions, and stick to your predefined trading strategy. Remember that volatility can create both opportunities and risks, and exercising patience can help you capitalize on favorable market conditions while minimizing potential losses during downturns.

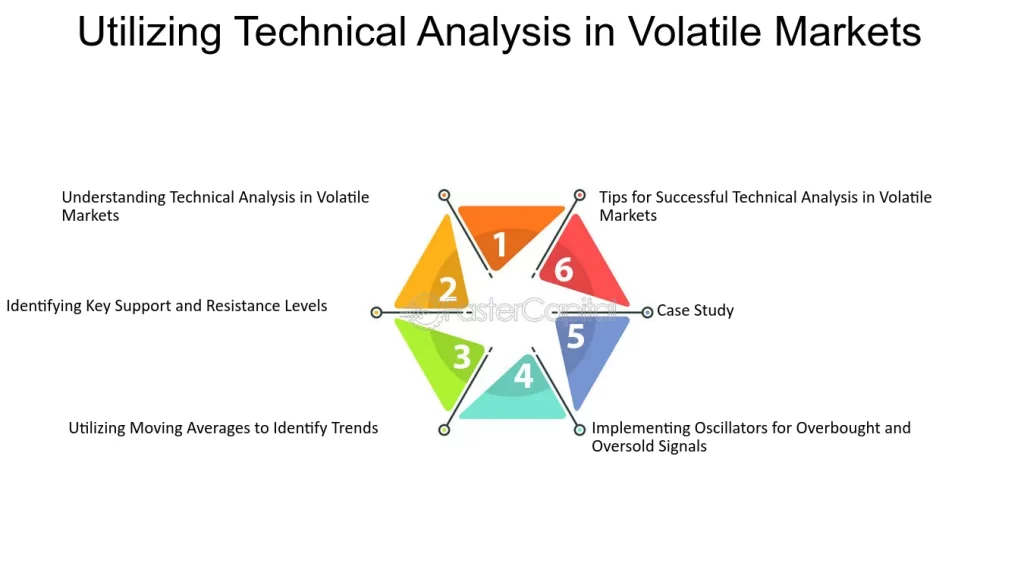

Utilize Technical Analysis Tools

Technical analysis can be a valuable tool for navigating volatile markets. By analyzing price charts and identifying key support and resistance levels, you can make more informed trading decisions. Utilize technical indicators such as moving averages, RSI, and MACD to gain insights into market trends and potential entry and exit points. Additionally, consider using volatility indicators like Bollinger Bands to gauge market volatility and adjust your trading strategy accordingly.

Stay Discerning and Manage Expectations

In volatile markets, it’s important to distinguish between noise and significant market movements. Not every price fluctuation warrants a trade, so exercise discernment and focus on high-probability opportunities. Manage your expectations and understand that not every trade will be profitable. By maintaining a realistic outlook and staying disciplined in your approach, you can navigate volatile markets more effectively and improve your overall trading performance.